|

The Outlook of Chinese Talc Trade

by Dr Jia Xiu Zhuang* Prof Jiang De Yu**

Abstract: China is the largest talc exporter although its quantity dropped

dramatically in recent years. The export prices have been increasing since

1996 when the quota was charged, and a further increase by USD5-15/mt

is expected within the next three to five years. China dominates on the

supply of white talc in the world. Asia is the largest market for Chinese

talc, while North America and West Europe are the fastest growing regions.

With the decline of talc in paper filler market, Chinese low grade talc

will combat for serious sales opportunities. On the other hand, the supply

of upper grade lump talc will fall short of the demand as the results

of two contrary trends of increasing requirement for talc filler PP in

automobile industry and the decreasing output of Chinese white talc. The

growth rate of talc import by China is remarkable since 1990. But it is

unrealistically optimistic to think that Chinese talc will enter a bright

era.

EXPORT

1. Review

China is the largest talc producer as well as the largest exporter in

the world. The export is the principal driving force for the development

of Chinese talc industry.

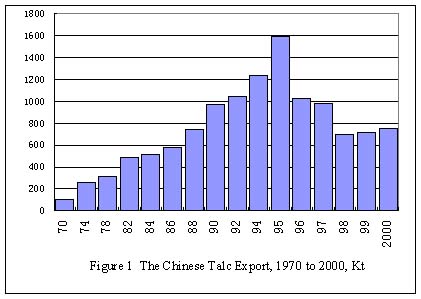

Figure 1 illustrates Chinese talc export between 1970 and 2000. In the

period of 1970 to 1995, Chinese talc export enjoyed a rapid growth of

annual rate 5.95%. The export quantity in 1970 was only 104.9 Kt, it reached

an all time high of 1.59 million tons, amounting to USD83.15 millions

in 1995, which accounted for the 67% of talc quantity traded worldwide

in the same year. China has had the leading shares on the world talc trade

since 1980s.

However, the export dropped dramatically since 1996.It was only 696.5

Kt in 1998, and 751.2 Kt in 2000,which was similar to the export in 1988.The

main reasons causing the dropping are as follows:

- Since 1996, the export quota was charged and the quantity was limited

by the government, which were 1000 Kt in 1996 and 1997,and down to 700

Kt after 1998. Despite Chinese talc export was subject to the quota

long time ago, the quota was not charged and the quantity was not limited

strictly until 1996. In order to save the quota charges, a large quantity

of talc, which should be shipped in 1996, was shifted to 1995 to export.

This made the export in 1995 larger than usual.

- The major market of Chinese talc is in Asia. The 65-95% of the export

talc is destined to Asian countries. The requirement of Asian market

had a crucial effect on Chinese talc export. Asian financial crisis

occurred in 1997 was seriously detrimental on the economies of some

Asian countries, resulting in the decline of talc import from China(Refer

to Table 1).

Table 1 Talc Import from China by Countries, 1995 to 2000, Kt

| Year |

Japan |

Korea |

Thailand |

Indonesia |

USA |

UK |

Italy |

Holland |

| 1995 |

67.7 |

40.79 |

5.69 |

6.7 |

8.55 |

1.54 |

2.35 |

2.77 |

| 1996 |

42.19 |

21.57 |

5.72 |

8.72 |

7.85 |

0.85 |

2.05 |

0.7 |

| 1997 |

42.18 |

16.27 |

4.46 |

6.93 |

8.4 |

0.83 |

1.77 |

2.11 |

| 1998 |

30.71 |

5.91 |

4.98 |

1.36 |

9.6 |

0.66 |

2.42 |

2.9 |

| 1999 |

26.93 |

5.09 |

5.56 |

2.3 |

12.14 |

0.87 |

4.03 |

4.19 |

| 2000 |

27.99 |

5.31 |

5.83 |

3.22 |

12.96 |

9.60 |

3.42 |

2.49 |

- The filler in paper industry is the largest consumption field of Chinese

talc. The 50-60% of the exported talc was used as paper filler. But

because of the consideration on the cost and environmental protection,

Asian paper industry have been switching to neutral or alkaline paper-making

since later 1990s, resulting in the decline of talc as filler. The talc

used as paper filler have dropped by 30% during the past ten years in

Asia, and it is expected a larger dropping will occur within the next

five to seven years.

- China has been exporting a large quantity of paper filler grade talc,

of which the principal raw materials are soapstones or chlorite. Before

1996,all such kinds of minerals were exported in the name of "Talc",

as there was no meaning to distinguish the difference between talc and

these minerals. But after 1996 when Chinese government extended charged

quota to the talc export, while soapstone, and chlorite were not included,

the exporters had to declare the formal "paper filler grade talc"

at Customs as their original names of soapstone or chlorite. Therefore

the talc export statistics after 1996 did not include the export of

soapstone and chlorite. This is an important reason for the appearent

decline of the talcum export after 1996 since about 250,000-300,000

paper filler grade talc have been exporting annually.

In contrast with the declining trend in Asian market, the talc export

to North America and West Europe have been increasing steadily after 1996(refer

to table 1). This was driven by the increasing demand for Chinese white

talc, which was used to produce talc-filler polypropylene for in automobile

industry.

2.IMPORTING COUNTRIES/REGIONS

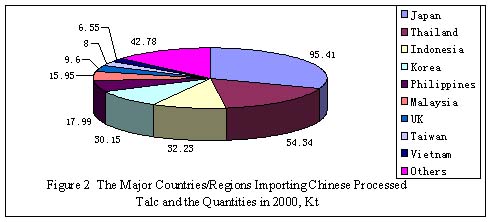

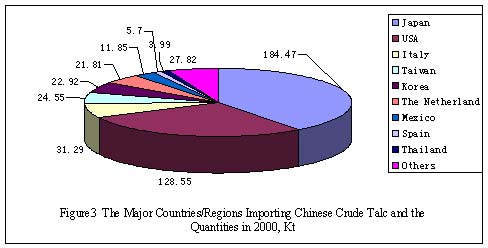

There were 74 countries/regions importing Chinese talc in 2000. Figure

2 illustrates the major countries/regions importing Chinese processed

talc, and Figure 3 the major countries/regions importing Chinese crude

talc. Japan, Thailand, Korea, Indonesia, Philippines, and Malaysia were

the leading importers of Chinese processed talc,while Japan, USA, Italy,

Taiwan, and Korea were the leading importers of Chinese crude talc.

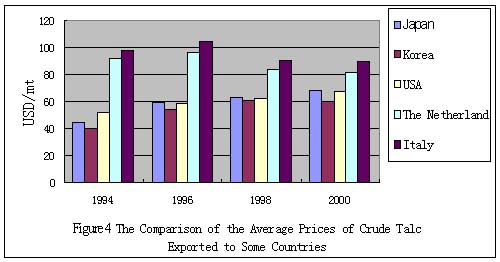

Figure 4 illustrates the average prices of crude talc exported to some

countries. In 1994, the prices to Japan and Korea were much lower than

the prices to USA and Western European countries because Japan and Korea

imported a large quantity of low grade talc chips used as filler in paper

industry at low prices, while USA and the Western Europe imported the

upper grade lump talc at high prices. But with the declining of talc filler

in paper industry in Asia, the requirement for talc chips dropped greatly

in recent years. On the other hand, with the developing of PP plastic

in Asia, the requirement for high grade lump talc was increasing. The

price differences between Asian market and USA, Western European markets

are narrowing.

Table 2 shows the proportion of Chinese talc export to Asia, North America,

West Europe, and other regions respectively. In 1984, the 92.6% of Chinese

talc was destined to Asia. Only 6.2%, 0.7%, and 0.5% were exported to

West Europe, North America, and other regions respectively. These data

indicated the main market for Chinese talc was in Asia at that time. The

situation had changed later on. Asian market shares dropped to 85.8%,

while total shares of other market shares went up to 14.2% in 1994. Asian

market share further dropped to 65.2% in 1999, the market shares of West

Europe, North America, went up to 16%, and 17% respectively. Both the

West Europe and North America were the fastest growing markets for Chinese

Talc, while the Asian market was shrinking.

Comparing to that of 1999,the Asian market share recovered to 68% in

2000. The American market share was stable, however, the West European

market share dropped by 5.1%.

Table 2 The Proportion of Chinese Talc Export to Various Markets, %

| Year |

Asia |

West Europe |

North America |

Other Regions |

| 1984 |

8206 |

6.2 |

0.7 |

0.5 |

| 1994 |

85.8 |

2.8 |

6.1 |

5.3 |

| 1999 |

65.2 |

16.0 |

17.8 |

1.0 |

| 2000 |

68.0 |

10.9 |

17.2 |

3.9 |

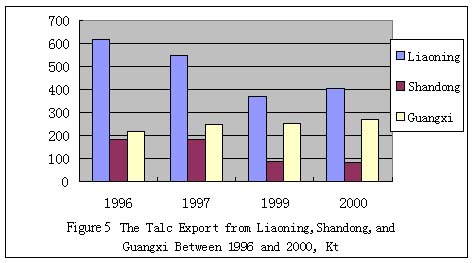

3.THE PRODUCING DISTRICTS AND COMPANIES

Despite talc deposits are found in 15 Chinese provinces, most of the export

quantity come from the provinces of Liaoning, Shandong, and Guangxi where

the talc reserves are larger and the qualities are better. Figure 5 illustrates

the talc export from the above three provinces between 1996 and 2000.

Liaoning was the largest talc exporter . More than half of the export

came from Liaoning. Guangxi was the second largest exporter. Shandong

was the third one. But it is noted the export of both Liaoning and Shandong

were dropping, while the export of Guangxi was going up during the past

five years. This clearly shows the potential of Guangxi talc, and it is

expected the growing trend will continue after 2000.

Table 3,and 4 show the export proportion of processed talc, and crude

talc from the three provinces. The 59.6-67.6% processed talc, and the

46.3-51.1% crude talc came from Liaoning. Liaoning was the largest exporter

for both processed and crude talc. But the proportion difference between

Liaoning and Guangxi is narrowing for the export of both crude and processed

talc. Table 5 lists the major Chinese talc producers.

Table 3 The Proportions of the processed Talc Exported from the Three

Provinces,%

| |

1996 |

1997 |

1999 |

2000 |

| Liaoning |

51.1 |

46.3 |

47.7 |

48.1 |

| Shandong |

15.6 |

15.7 |

9 |

8.6 |

| Guangxi |

33.3 |

38 |

43.3 |

43.3 |

Table 4 The Proportions of the Crude Talc Exported from the Three Provinces,%

| |

1996 |

1997 |

1999 |

2000 |

| Liaoning |

67.6 |

64.5 |

59.5 |

61.8 |

| Shandong |

19.7 |

21.5 |

16.6 |

13.3 |

| Guangxi |

12.7 |

14 |

23.9 |

24.9 |

Table 5 The Major Chinese Talcum Producers

Liaoning Aihai Talc Co Ltd

Haichen Beihai Minerals Co Ltd

Haichen Shuiquan Talcum Mining Co Ltd

Haichen Pailou Talc Co Ltd

Shandong Pingdu Talc Co Ltd

Shandong Laizhou Talc Co Ltd

Guilin Guiguang Talcum Development Co Ltd

Guangxi Longguang Talcum Development Co Ltd

Guangxi Longsheng Huamei Talc Development Co Ltd

--------------------------------------------------------

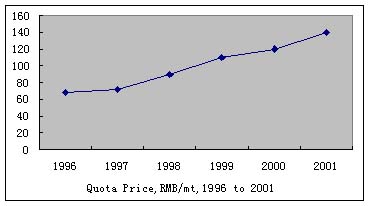

4.EXPORT QUOTA

Chinese talc export was subject to the quota long time ago. But the quota

was not charged until 1996.The exporters got the quota by bidding in the

"open tender", and/or by the distribution in the "agreement

tender" automatically. Figure 6 shows the quota market price since

1996.

It is noted the market prices were going up continuously. The reasons

for the continuous increasing of the prices were very completed, but the

following two points are crucial:

- The quota quantity was less than the actual requirement.

- The exporters had to offer a higher price in "open tender"

to ensure to get the quota, in order to keep the continuity of exporting,

and fight for advantage positions in next year "agreement tender"

to get cheaper quotas.

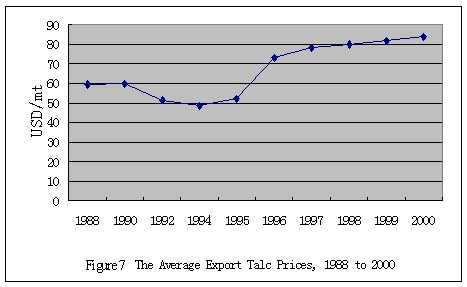

Figure 7 shows the average export talc price between 1988 and 2000. In

1990s the price went down and down until 1996 when the quota was charged,

then the price recovered continuously. Besides the quota, the increases

of mining, processing, and the domestic transportation costs were other

factors pushing the price upwards.

Table 6 shows the proportion of quota costs in the FOB Prices of some

typical Haichen Talc powder. The quota costs toke not small shares in

the export prices, especially for the low grade talc.

Table 6 The Proportion of Export Quota Cost in FOB Bayuquan Price in

2000,%

| 1250 MESH MICRONIZED POWDER |

4-8% |

HAICHEN TALC POWDER SUPER GRADE

|

10-13% |

| HAICHEN TALC POWDER NO.1 |

11-15% |

| LIAONING TALC POWDER NO.2 |

19-23% |

IMPORT

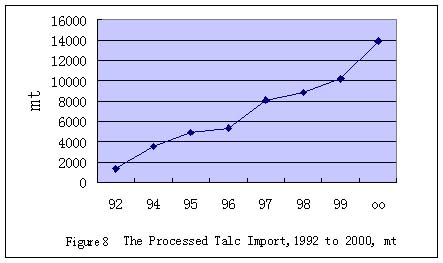

Figure 8 shows the Chinese talc import between 1992 and 2000.It is surprised

of as the largest talc producer and exporter, China's import has been

increasing rapidly since 1992 with the annual rate of 91.5%. In 1992,

the imported quantity was only 1376 mt, while in 2000 it reached 13.7

Kt, amounting to USD6.83 million. The import talc were all micronized

powder at the price more than USD400/mt, which was more than the double

price of Chinese export for the same grade. The products were mainly imported

from Taiwan, USA, Japan, Belgium, and Norway.

Before 1990s,China had few requirements for micronized talc or other

sophisticated products. The 325 mesh powder was the standard product required.

Since 1980s, China imported some industrial lines which using micronized

talc. The designed talc to be used in these lines were based on the overseas

talc products. When these lines operated in China, they continued to use

the talc recommended by the designers ,which was processed in overseas.

Besides, some of Chinese industries, such as automobiles, paint, plastic,

developed rapidly in recent years, which also require the micronized and

sophisticated talc.This is another factor stimulating the Chinese talc

import.

OUTLOOK

Despite talc is found in 15 provinces, Larger reserves were found in Liaoning,

Jiangxi, Shandong, Guangxi, and Qinghai. The total reserves of above five

provinces account for more than the 94% of Chinese talc reserve. The largest

talc reserve is found in Jiangxi, however,the talc there is in black.

The white talc mainly comes from Liaoning, Shandong, and Guangxi.

China dominates in white talc. Although talc is widely distributed in

the world, America, Europe, and Asia all having large reserves, only a

limited quantity of the reserves is white talc with whiteness more than

85%. The quantity with whiteness over the 90% is rare. The world output

of the talc with whiteness over 90%, except Chinese output, is only about

30,000mt. China has the largest white talc reserves and output in the

world. The annual output of talc with whiteness over the 88% is about

350 Kt, and that with whiteness over 85% is about 1.2 million mt. Chinese

white talc enjoys a good reputation for its high quality and competitive

price. Most of the white talc in the world originates from China although

some of them are processed in other countries. No white talc from any

other country is able to compete with Chinese product in regard to the

quantity and price. Table 7 lists the principal upper grade Chinese white

talc:

Table 7 The Principal Upper Grade Chinese Crude Talc

| Grade |

Whiteness,% |

| Haichen Lumps No.1 |

94 |

| Haichen Lumps No.2 |

92 |

Haichen Lumps No.3

|

86-88 |

| Guangxi Super Lumps |

92 |

| Guangxi Lumps No.1 |

88-90 |

| Guangxi Lumps No.2 |

85-88 |

| Pingdu Super Lumps |

90-92 |

| Pingdu Lumps No.1 |

85-90 |

| Laizhou Super Lumps |

90 |

| Laizhou Lumps No.1 |

85 |

Before 1993, Chinese talc output was between 700 to 900 Kt. In 1994 it

went up to 1.34 million tones, and in 1990 it reached the peak of 2.54

millions mt. But because of the excessive mining in the last two decades,

both the reservation and the output have been dropping during the 1990s.

The output of lump talc dropped even faster comparing to talc chips, and

the quality went down as well. The current annual talc output is less

than 2 millions mt. It is forecast the output will drop to 1.7 millions

mt within the next 3 to 5 years. Both the mining cost and the market price

will increase. This trend appeared clearly in 2001.It is expected Chinese

talc price will increase by USD5-15/mt within the next 3 to 5 years, which,however,

should be in the acceptable scope when considering its unique quality.

With more and more application of talc filler PP in automobile industry,

the world market will have larger requirement for talc with high and medium

whiteness. Within the next 3 to 5 years, the world market will require

about 800,000 Chinese talc annually(not including the paper making talc).

Although Chinese white talc will continue dominate the world market,

it is unrealistically optimistic to think that Chinese talc will enter

a bright ear, when considering the following factors:

- The Chinese talc reserves are decentralized widely. There are hundreds

of independent mines and processors. Talc producers and traders compete

with each other from the low grade to the top grade products. Although

some upper grades talc obviously falls short of the demand, the companies

still compete each other for export, as they do not dare to lose the

foreign customers and indulge in fantasy that some day more talc will

appear in their mines. The majority of producers' revenues keep in the

lowest level, which are only enough for surviving, not to mention the

development. If there is no reorganization or merging among the major

producers, the current malignant competition will not be stopped. Unfortunately,

until now no positive trend appears, although soon or later it will

do.

- Despite the export price have gone up since 1996 when the quota was

charged, Majority money resulting from the price increase was collected

by the government in the name of quota charges. Most talc producers

have no obvious profits increase ,which is urgently needed for the mines'

developments.

The 60% of Chinese talc are in chip form, which main application is

as paper filler in Asian paper industry. Within the next 3 to 7 years,

the acid paper making will be replaced by neutral or alkaline paper

making in Asia. Talc has to withdraw from the paper filler market soon

or later. If no new applications can be found, Chinese low grade talc

may face a serious decline in sales.

It is a remarkable achievement in recent years that most of the Chinese

leading talc producers mastered the processing technology of micronized

talc. The quality of the micronized product is good enough to be accepted

by most consumers, and the price is the most competitive in the world.

The standard product is 800mesh, 1250mesh, 2500mesh,or even finer. More

and more orders have been placed since 1999. In 2001 most producers are

in full operation. The output of micronized powder was 90,000 mt in 2000,

and will be about 100,000 mt in 2001.It is expected the output will be

over 120,000 mt within the next 2 years.

In summary, the supply of the upper grade lump talc will fall short of

demand ,while the low grade talc will still be a drug on the market. The

output of micronized products will continue to increase and find more

consumers. The following is the forecast of the principal markets:

- North America,and West Europe

These two markets mainly require Chinese top lump talc and top powder

products. As the output of lump talc is decreasing, it is impossible

to increase the export anymore, the supply will fall short of demand,

the price will go up. But the supply of upper grade powder will have

not much problems. Chinese producers prefer to supply high value-added

powder products rather than the lump in order to get a proper profits.

Also the upper powder product can be made partially from top grade talc

chip, which is available at a very cheap price.

- Japan and Korea

Currently Japan and Korea are the largest importers of Chinese talc.

But the import will drop quickly in the near future, because the quantity

of paper filler grade talc will go down dramatically,although it will

be partially offset by the increasing requirement of upper grade products,

especially the micronized talc.

- South East Asia

South East Asia market mainly requires low to medium grade products.

The supply of these products will be sufficient, the price will be steady.

South East Asia will not have more requirements for lump talc, however

it is the largest potential market for Chinese micronized products.

- China

The paper filler market will continue to shrink, however, the requirements

for upper grade talc products will increase greatly in the field of

plastic, paint, pharmaceutics, and cosmetics. In contrast with the past,

it is a significant the talc sale profits inside China are higher than

the export ones nowadays. What more the domestic trade is simple, which

has no need for quota, the currency control, and so on. The leading

Chinese producers are turning more attentions to the domestic market.

In the next few years, micronized and pharmaceutical grade talc will

be the two grades with fastest growing rates in sales.

|